Built for Financial Services

Reduce risk and unlock efficiency across financial workflows with AI-driven automation that cleans, validates, and reconciles messy First-Mile Data™. Adeptia Automate offers breakthrough capabilities that make integration faster, smarter and easier than ever.

Our Industry Expertise

Adeptia brings over two decades of financial services expertise to our Intelligent Data Automation™ platform to solve your most persistent First-Mile Data challenges. Our purpose-built financial services solutions are designed to reflect and address real-world workflows and regulatory demands, so your teams can automate with speed and control.

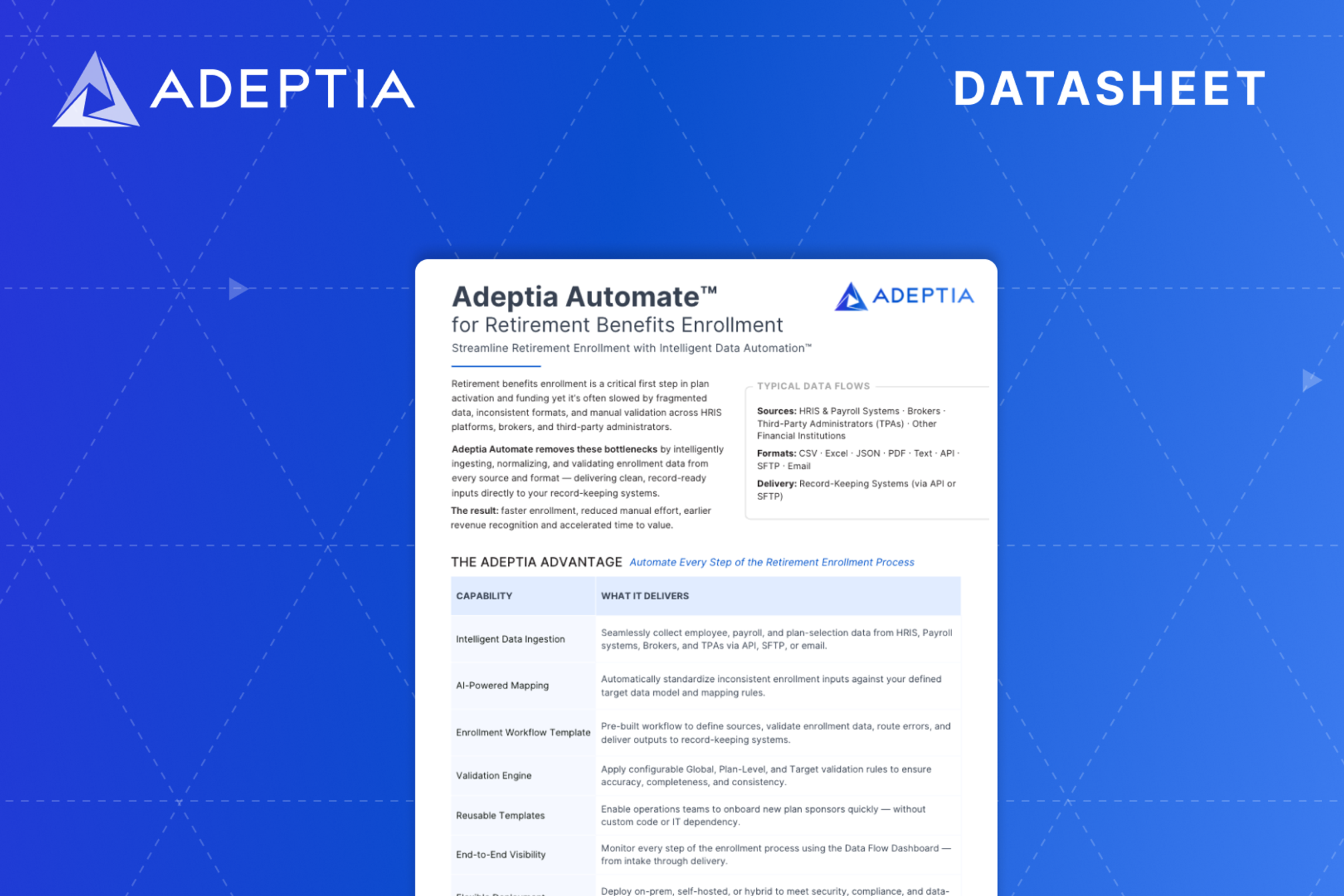

With process accelerators built specifically for financial services, Adeptia Automate streamlines the intake and processing of First-Mile Data across enrollment, plan switchovers, ongoing contribution changes and more. Using AI-driven precision at scale, the platform extracts, standardizes, and validates unstructured data from retirement benefit enrollment forms, employer files, spreadsheets, and legacy formats into accurate, audit-ready records—reducing manual effort, minimizing errors, and accelerating processing while supporting compliance across complex financial ecosystems.

Who We Serve

Adeptia enables companies across a variety of financial services segments to integrate their First-Mile Data seamlessly.

Retirement Benefits

Investment Management

Third-Party Administrators

Payroll and HR Providers

Financial Software Vendors

One of the largest commercial banks in the United States offers a comprehensive line of banking, investment, mortgage, trust, and payment products to consumers, businesses, and institutions.

Company Size

Enterprise

Industry

Financial Services

"A single architecture, a single platform, and a single source of truth are all the Bank needs to remain competitive in the financial marketplace."

See Adeptia in Action

Schedule a personalized demo and discover how Adeptia can help you move faster, work smarter, and scale with confidence.

Resources

Related Resources

The Hidden Cost of Delayed Asset Onboarding in Retirement Benefit Services

Delayed retirement plan onboarding costs providers $40K+ monthly in deferred revenue. Learn how Intelligent Data Automation cuts transition times by 80%....

Quick Guide to Our Retirement Benefits Enrollment Accelerator

Automate retirement enrollment data from any source. Reduce processing from weeks to hours with AI-powered mapping and validation....

Unlock Business Potential: Support LIMRA’s LDEx Data Standards

Today’s data-driven businesses, regardless of industry vertical, need to streamline and speed operations. For each aspect of business, it seems there’s another data standard to embrace in order to int...